The American Digital Payments Revolution

Originally published in the November issue of The Green Sheet:

The American digital payments revolution began in the mid-1990s and gradually evolved over time. However, it was the global pandemic of 2020 that accelerated the need for alternative payment platforms due to mobility restrictions. As consumers were forced to adapt and explore these new methods, they discovered that, contrary to initial hesitations, these alternatives offered significant convenience. This shift in perspective highlighted that the benefits of digital payments were well worth the transition.

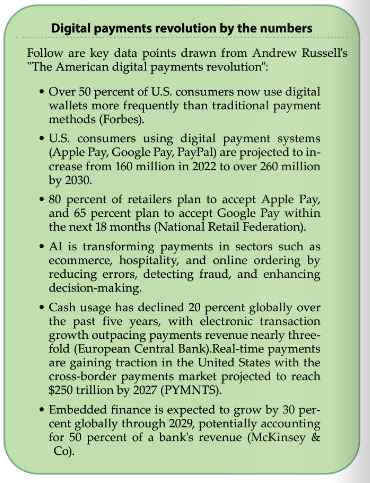

A 2023 Forbes study confirmed an explosion in the use and integration of digital wallets. More than half of U.S. consumers now use digital wallets more frequently than traditional payment methods like cards and cash.

Skyrocketing Consumer Use

The number of U.S. consumers utilizing digital payment systems such as Apple Pay, Google Pay, and PayPal is projected to skyrocket from 160 million in 2022 to over 260 million by 2030, according to recent projections.

Additionally, the National Retail Federation reported that within the next 18 months, 80 percent of retailers plan to accept Apple Pay, and 65 percent intend to accept Google Pay.

Google Pay and Apple Pay facilitate payments via NFC technology and also support online transactions on mobile devices with Android or iOS operating systems. Both systems ensure that the recipient of the payment does not receive any personal information about the payer. Similarly, platforms like Amazon Pay and PayPal offer enhanced security for online transactions by keeping the payer’s personal data and account numbers private.

Continuous Analysis through AI

Artificial intelligence (AI) is rapidly making its way into the payments market, transforming sectors such as ecommerce, online ordering, hospitality and the restaurant industry. AI leverages automated learning through sophisticated algorithms and specialized programming, enabling continuous data analysis and interaction improvements.

This technology helps to minimize or eliminate errors (potentially meeting Six Sigma standards), detect fraud and enhance decision-making processes.

The European Central Bank reported a 20 percent global decline in cash usage over the past five years, while the growth rate of electronic transactions has nearly tripled

that of payments revenue. The landscape is diverse and expansive, encompassing a wide range of players, both traditional and non-traditional. This includes banks, retailers (such as stores, gas stations and pharmacies), fintech companies, related institutions, independent software vendors, processors and more.

Currently, credit and debit cards are the most commonly used online payment methods. To accept these payments in an ecommerce setting, you need to implement a payment gateway or virtual POS. A virtual POS functions as the digital equivalent of the physical POS terminals found in retail stores, allowing for secure card transactions online.

Proliferation of New Options

As the payments industry continues to rapidly evolve globally, real-time payments are gaining momentum in the United States with the introduction of the FedNow platform and other technologies provided by fintech companies and financial institutions. When discussing real-time payments, it’s also important to consider cross-border payments—a market opportunity projected to reach $250 trillion by 2027, according to analysts and financial institutions (PYMNTS).

Embedded finance, also known as integrated finance, is anticipated to grow by over 30 percent globally through 2029. This approach allows for the integration of financial services across various industries, fostering new business models. It facilitates the provision of lending, insurance and payment services without the need to develop the underlying infrastructure or obtain regulatory approvals. (PricewaterhouseCoopers)

As major corporations and financial institutions increasingly offer embedded financial services such as digital wallets, prepaid cards, credit cards, loans and insurance, many banks are beginning to partner with fintech companies. This business model has the potential to account for up to 50 percent of a bank’s revenue (\Embedded finance: Who will lead the next payments revolution?\ (McKinsey & Co).

Evolving Customer Demands

Fintech and the payments industry will continue to experience rapid technological advancements to meet evolving customer demands and adapt to shifting geo- political, regulatory and global economic conditions. The range of money movement methods is expanding at an accelerated pace.

Users are increasingly seeking all-in-one solutions that provide access to essential services through a single platform, enabling efficient and secure management of both personal and business needs. Digitalization is poised to address socio-economic disparities and in- equalities, offering improved money management options for people of all nationalities and ages across the United States and the Americas.

Note: the following resources are referenced in this article:

• \COVID-19 drives global surge in use of digital payments,\ June 29 www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge- in-use-of-digital-payments

• \Embedded finance: Who will lead the next payments revolution?\ Oct. 13 www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-who-will-lead-the-next-payments-revolution

• \What does embedded finance mean for business?\, PricewaterhouseCoopers, June 16, 2024, www.pwc.com/gx/en/issues/technology/tech-translated-embedded-finance.html

• \Capturing the $250 trillion cross-border payments opportunity,\ PYMNTS www.pymnts.com/news/cross-border-commerce/cross-border-payments/2024/capturing-the-250-trillion-cross-border-payments-opportunity/

Andrew Russell is the president and CEO of Sound Payments, a key player in the payments integration, POS and cloud services space. Over the years, Andrew has held various positions in the banking and financial sectors, the most current being the CEO of Mid-Atlantic Federal Credit Union. After 34 years of service in the U.S. Navy and U.S. Army, Andrew retired from military service with the rank of Major. Currently, he is in the process of publishing his new book Creating a Leader – An American Story.

Contact him via LinkedIn at www.linkedin.com/in/andrewprussell.